Caring for senior dogs with medical issues requires a significant investment of time and money and we depend on donations and sponsorship to fund the care of all our resident dogs. Apart from the methods listed below, you can also contribute to our cause via Cheque/Demand Draft/Direct Deposit. Contact us on +91 77208 90457 for the required details.

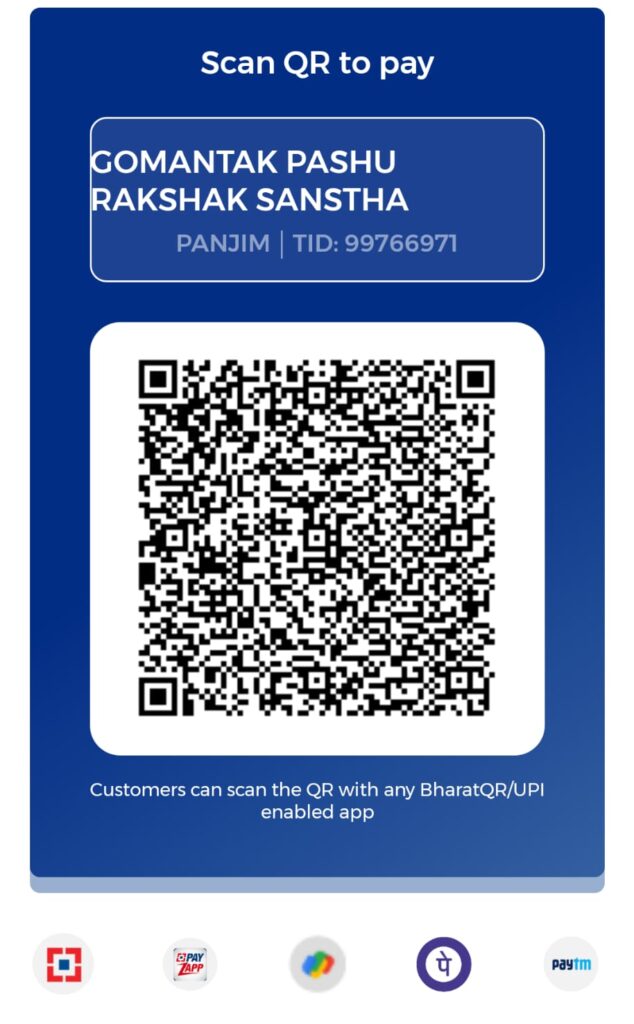

Scan our QR code to make a donation via UPI / PayTM / GPay / PhonePe. IN INDIA ONLY

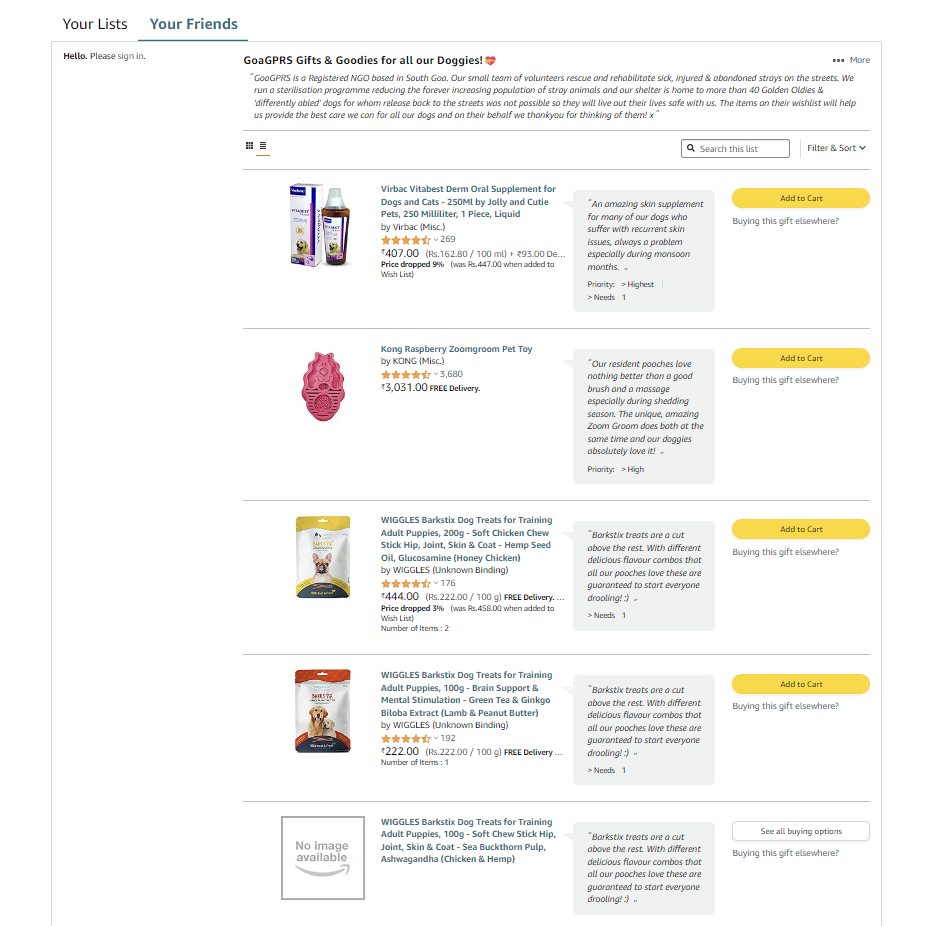

From tonics and treats to collars and beds, there is a lot that goes into caring for senior dogs. Donate by ordering some of our most used items.

Some of our senior dogs have complications that require lifelong medical care. By sponsoring a dog, you help us ensure that their needs are met.

Call +91 9075110346 to join our GPRS Sponsor Family and let us find you the perfect pooch to sponsor!

Other ways you can donate are:

– Cheques/Demand Drafts

– QR code

– Direct Bank Deposit

– GooglePay / PayTM

Every contribution helps us to meet the needs of our senior dogs. Most have some health issues that require daily medications or tonics. As dogs age, they suffer similar diseases to human ailments, such as arthritis, heart problems, etc. Your contribution, no matter how small, will help.

When you donate to an NGO on a monthly basis, not only do you help us with recurring expenses, but also help us plan our work.

Yes – all donations to GPRS are 50% tax deductible under section 80G of the Income Tax Act. This tax benefit is valid only in India.

We will send you your donation receipt either by email or by post to your address. In addition, Form 10BE will be issued after the end of the financial year, this should be included with your tax filing. If you’ve changed your email ID or your address, please contact us with the updated details.

Yes up to Rs.2,000/- with Government issued ID, such as a PAN card or Aadhar card. Cash donations above Rs.2,000/- are not eligible for an 80G deduction.

Absolutely. We have stringent security measures in place to ensure that critically sensitive information, such as your personal information and your credit/debit card details, are protected.

NRI (Non-Resident Indian) donors, who are Indian citizens, holding an Indian passport are eligible to tax exemption under section 80G of the Income Tax Act. Please ensure to mention your Indian PAN Card Number in the online donation form to avail of the tax benefits.

GPRS Sanctuary

Major District Road 47, Adnem, Quepem, Goa, India – 403703

Visits by appointment only

Get in touch

+91 7720890457

[email protected]

Mon-Fri: 9am-1pm, 3pm-5pm

Sat: 9am-1pm